| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Forex Trading Calendar

Forex Holidays - When Forex Market Open?

|

Extreme TMA System

At the request of many of you, I am starting today what I hope will become a thriving laboratory of ideas that will make each of us, each day, a little better trader than we were. Firstly, I must say that I have never done something like this and I will rely on the help and contribution of you to make it a success.

The history of a trader, like my own, is a tough road full of failure, despair and loneliness, as well as fulfillment, excitement and triumph. It is a hard road full of obstacles and temptations to lead you astray from the path and in the end, only a determined few will succeed in conquering the many mines and potholes in the way and acquiring the discipline and knowledge necessary to succeed.

My own history is a good example of what most of us go through. Luckily, because I had a successful company, I was able to draw funds to pay my "tuition" in the University of Trading. Over the first few years I suffered very heavy losses. Read many books, talked to everyone that I met that knew something about the field. Over and over again, I stumbled over the same obstacles. I couldn´t figure out why if I had been successful in other areas of my life, I was having such hard time with this. I quit several times, only to give it "one more try" and continue on my quest. As I look back on these years now, I truly believe they were necessary to forge the discipline and determination necessary to succeed. Yes, there are traders that have never experienced the "Valley of Despair", but they are few and far between. For the rest of us the way is hard but full of promise and a daily constant battle to control ones ego and remember the lessons learned. After 30 years, I can say I have learned a bit, but there is more to learn every day. The finish line is never reached and that is the wonder and thrill of this profession.

Up front I ask for your help and contribution. Let us be constructive and share our knowledge. If we do, this will have been worth while.

The System: Extreme TMA.

The market, like a pendulum, is a never ending sequence of extremes. It forever tries to reach the mean but never succeeds, constantly overshooting it´s mark, reversing and trying it again but always failing to reach balance. This system attempts to capture those extremes. It is a compendium of my understanding of the market, brought to it´s simplest expression.

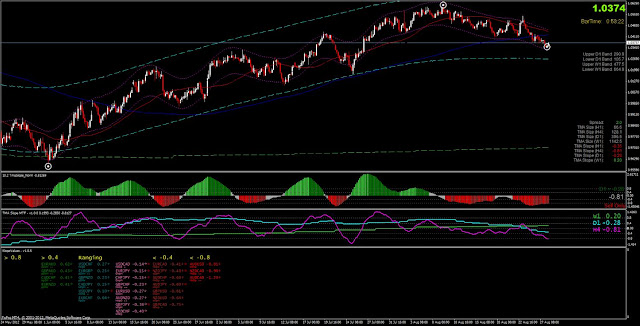

The principles are not complicated. The first indicator, the TMA shows us the average of the path that the price action in the market is following. As such, it is a backward looking indicator and attempts to determine the future from the recent history. It corrects itself by repainting itself. It has two outer bands that show us the outer boundaries of price movement that we are searching for. Our second indicator, the TMA Slope indicator will show us the relative change in the slope of TMA as compared to previous candles. It determines in which direction a trade must be placed and also shows divergences to price. For example, if price is rising but the slope indicator is dropping, it is announcing a high probability of a drop in price in the near future. The steeper the drop in the indicator the higher the probability of a drop in price. The same concept applies in reverse in the case of a dropping price and a rising slope indicator. A third use of the slope indicator is for divergence detection. If you see 2 or 3 green mounds, each smaller than the one before it, there is a strong likelihood that price is about to drop. 2 or 3 Red mounds, each smaller than the one before it, indicates a high probability of a price rise. On the right side of the Slope indicator you will see the value (grey) of the current chart time frame. Above it the slope value of the D1 time frame and below the trade status (Ranging, Buy Only or Sell Only) of the current chart TF. The third indicator is TMA Slope MTF which gives us the slopes of all 3 time frames. The final indicator gives us the D1 slope values of all currency pairs. A great tool to determine which pairs are possible trades.

MTF TMA:

Included in the templates are 3 TMA indicators. The H4 TMA (dotted magenta lines), the D1 TMA (dashed blue lines) and the W1 TMA (dashed green lines). All 3 will be visible on a M15, H1 or H4 chart. The H4 time frame are for trades of 1 to 5 days and potential gain of 170 to 250 pips. The D1 time frame are for trades of 5 to 30 days and potential gain of 200 to 400 pips. If you set the chart to D1, you will only see the D1 and W1 TMAs. If you set the chart to W1, you will only see the W1 TMA. If you are a short term trader, a good alternative option is to add the H1 TMA and use the other 3 ( H4, D1, W1) for trend direction. Having several TMAs on one chart is extremely helpful for determining longer time frame trends and combined, they have high predictive value of future market moves.

Stop Loss Use:

There are various options in this department and I won´t recommend any particular one. A natural level to place your SL would be above a previous high for a short and below a previous low for a long. I myself use only an emergency SL very far away from the PA (100 Pips). If a trade goes against me, I will use Recovery Trades to exit the trade at breakeven. I have included detailed instructions describing the Recovery system in the Documents folder contained in the Packet.zip file. The extreme TMA system works much better when you leave price plenty of room to move.

Entry Rules:

Even though not explicitly mentioned in the rules, it is always a good idea to sell from under tested support and buy from above tested resistance. This is always a good rule to follow. It will prevent getting into a trade too early and will increase your percentage of winners. Valid support and resistance areas are: 50 or 200 MAs, TMA centerlines, daily, weekly and monthly pivot lines, etc.

Exit Rules for each type of trade:

Short Term Trade (If used):

Close the trade when price reaches the opposite H1 TMA band. Reenter trade when price retraces to the centerline of the H1 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Medium Term Trade (Standard trade):

Close the trade when price reaches the opposite H4 TMA band. Reenter trade when price retraces to the centerline of the H4 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Position Trade:

Close the trade when price reaches the opposite D1 TMA band. Reenter trade when price retraces to the centerline of the D1 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Attachments:

I am enclosing a Template and Indicators compressed as a Packet.zip file. Extract it and as usual, place the indicators (.mq4 and .ex4 files) in the Experts/Indicators folder of your MT4 installation. Place the Template (.tpl file) in the Templates folder (not in the Experts/Templates folder). The Extreme TMA - New Version template is designed to follow one currency pair on one screen. Also included is the new Dashboard (!ExtremeTMA v37) which informs us of what pairs are complying with the rules in real time.

That´s it ! The system is simple in concept and easy to trade. I recommend that you handle it with care. Use demo accounts or small lots until it shows itself to be consistently profitable and you acquire confidence in it. A trading system will only work consistently if you truly believe in it. As we move forward, I´m sure we will improve it and make it ever more reliable.

Good luck and welcome to our New Adventure !

Hall of Fame: The following members have collaborated or have made a positive impact on making this system a better one. The underlined names have made extraordinary contributions:

Crodzilla , shahrooz67, Paradox, lologo, NanningBob, Zznbrm, X-Man, Favorite, EasyRyder, mladen, Argonod, Olarion1975, Ever E. Man, Faxxion, flaw, Riddermark, slowpokeyjoe, beto21 cwb, Trainman, Baluda, bassramy.

The history of a trader, like my own, is a tough road full of failure, despair and loneliness, as well as fulfillment, excitement and triumph. It is a hard road full of obstacles and temptations to lead you astray from the path and in the end, only a determined few will succeed in conquering the many mines and potholes in the way and acquiring the discipline and knowledge necessary to succeed.

My own history is a good example of what most of us go through. Luckily, because I had a successful company, I was able to draw funds to pay my "tuition" in the University of Trading. Over the first few years I suffered very heavy losses. Read many books, talked to everyone that I met that knew something about the field. Over and over again, I stumbled over the same obstacles. I couldn´t figure out why if I had been successful in other areas of my life, I was having such hard time with this. I quit several times, only to give it "one more try" and continue on my quest. As I look back on these years now, I truly believe they were necessary to forge the discipline and determination necessary to succeed. Yes, there are traders that have never experienced the "Valley of Despair", but they are few and far between. For the rest of us the way is hard but full of promise and a daily constant battle to control ones ego and remember the lessons learned. After 30 years, I can say I have learned a bit, but there is more to learn every day. The finish line is never reached and that is the wonder and thrill of this profession.

Up front I ask for your help and contribution. Let us be constructive and share our knowledge. If we do, this will have been worth while.

The System: Extreme TMA.

The market, like a pendulum, is a never ending sequence of extremes. It forever tries to reach the mean but never succeeds, constantly overshooting it´s mark, reversing and trying it again but always failing to reach balance. This system attempts to capture those extremes. It is a compendium of my understanding of the market, brought to it´s simplest expression.

The principles are not complicated. The first indicator, the TMA shows us the average of the path that the price action in the market is following. As such, it is a backward looking indicator and attempts to determine the future from the recent history. It corrects itself by repainting itself. It has two outer bands that show us the outer boundaries of price movement that we are searching for. Our second indicator, the TMA Slope indicator will show us the relative change in the slope of TMA as compared to previous candles. It determines in which direction a trade must be placed and also shows divergences to price. For example, if price is rising but the slope indicator is dropping, it is announcing a high probability of a drop in price in the near future. The steeper the drop in the indicator the higher the probability of a drop in price. The same concept applies in reverse in the case of a dropping price and a rising slope indicator. A third use of the slope indicator is for divergence detection. If you see 2 or 3 green mounds, each smaller than the one before it, there is a strong likelihood that price is about to drop. 2 or 3 Red mounds, each smaller than the one before it, indicates a high probability of a price rise. On the right side of the Slope indicator you will see the value (grey) of the current chart time frame. Above it the slope value of the D1 time frame and below the trade status (Ranging, Buy Only or Sell Only) of the current chart TF. The third indicator is TMA Slope MTF which gives us the slopes of all 3 time frames. The final indicator gives us the D1 slope values of all currency pairs. A great tool to determine which pairs are possible trades.

MTF TMA:

Included in the templates are 3 TMA indicators. The H4 TMA (dotted magenta lines), the D1 TMA (dashed blue lines) and the W1 TMA (dashed green lines). All 3 will be visible on a M15, H1 or H4 chart. The H4 time frame are for trades of 1 to 5 days and potential gain of 170 to 250 pips. The D1 time frame are for trades of 5 to 30 days and potential gain of 200 to 400 pips. If you set the chart to D1, you will only see the D1 and W1 TMAs. If you set the chart to W1, you will only see the W1 TMA. If you are a short term trader, a good alternative option is to add the H1 TMA and use the other 3 ( H4, D1, W1) for trend direction. Having several TMAs on one chart is extremely helpful for determining longer time frame trends and combined, they have high predictive value of future market moves.

Stop Loss Use:

There are various options in this department and I won´t recommend any particular one. A natural level to place your SL would be above a previous high for a short and below a previous low for a long. I myself use only an emergency SL very far away from the PA (100 Pips). If a trade goes against me, I will use Recovery Trades to exit the trade at breakeven. I have included detailed instructions describing the Recovery system in the Documents folder contained in the Packet.zip file. The extreme TMA system works much better when you leave price plenty of room to move.

Entry Rules:

1- We will first determine trend in the 3 TMAs by using the TMA Slope indicator values.

Ranging TMA (-0.40 to 0.40): Trades can be placed in both directions.

Buy Only TMA (Above 0.40): Place ONLY Long trades.

Sell Only TMA (Below -0.40): Place ONLY Short trades.

Super Range: Above 0.80: Hold longs till slope value drops under 0.80, at which point you should close all longs.

Below -0.80: Hold shorts till slope value climbs above -0.80, at which point you should close all shorts.

H4, D1, W1 slope values must be either Ranging or higher for Longs or Ranging or lower for shorts.

2- Once trade direction is determined, we will look at the D1 and W1 TMA and determine that there is enough room for the trade to move in your direction before reaching the outer band of both. Example: If you decide to go short, there must be enough room between the current price and the lower D1 band (At least 150 pips) and the lower W1 band (At least 250 pips).

3- We will now wait for price to climb above the top band of the H4 and D1 TMAs at the same time, before placing a Short trade or below the bottom band of the H4 and D1 TMAs at the same time, before placing a Long trade.

4- The Trigger: Once Rule 3 is complied with, the trade will be entered once price turns around and touches the H4 Upper TMA band for Shorts or the H4 Lower TMA band for Longs. Refer to Rule one again before entering trade to make sure that the 3 TMA slope values are still Ranging or in the direction of your trade. If they are not, wait until they return to the correct slope values for your trade and enter then.

Even though not explicitly mentioned in the rules, it is always a good idea to sell from under tested support and buy from above tested resistance. This is always a good rule to follow. It will prevent getting into a trade too early and will increase your percentage of winners. Valid support and resistance areas are: 50 or 200 MAs, TMA centerlines, daily, weekly and monthly pivot lines, etc.

Exit Rules for each type of trade:

Short Term Trade (If used):

Close the trade when price reaches the opposite H1 TMA band. Reenter trade when price retraces to the centerline of the H1 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Medium Term Trade (Standard trade):

Close the trade when price reaches the opposite H4 TMA band. Reenter trade when price retraces to the centerline of the H4 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Position Trade:

Close the trade when price reaches the opposite D1 TMA band. Reenter trade when price retraces to the centerline of the D1 TMA. Make sure all slope values continue to be either ranging or in the direction of your trade before reentering. You can do this several times during a strong trending move.

Attachments:

I am enclosing a Template and Indicators compressed as a Packet.zip file. Extract it and as usual, place the indicators (.mq4 and .ex4 files) in the Experts/Indicators folder of your MT4 installation. Place the Template (.tpl file) in the Templates folder (not in the Experts/Templates folder). The Extreme TMA - New Version template is designed to follow one currency pair on one screen. Also included is the new Dashboard (!ExtremeTMA v37) which informs us of what pairs are complying with the rules in real time.

That´s it ! The system is simple in concept and easy to trade. I recommend that you handle it with care. Use demo accounts or small lots until it shows itself to be consistently profitable and you acquire confidence in it. A trading system will only work consistently if you truly believe in it. As we move forward, I´m sure we will improve it and make it ever more reliable.

Good luck and welcome to our New Adventure !

Hall of Fame: The following members have collaborated or have made a positive impact on making this system a better one. The underlined names have made extraordinary contributions:

Crodzilla , shahrooz67, Paradox, lologo, NanningBob, Zznbrm, X-Man, Favorite, EasyRyder, mladen, Argonod, Olarion1975, Ever E. Man, Faxxion, flaw, Riddermark, slowpokeyjoe, beto21 cwb, Trainman, Baluda, bassramy.

Forex swapping

Everything You Need To Know About Forex Swap or Rollover Rates

Many forex traders, particularly novices, may be very confused about forex swaps that are more commonly known as ‘rollover rates’. To start understanding this subject properly, you need to understand that all forex trades must be settled in two business days from their activation date.

The which means of this, is that in the event you opened a currency trade, you have to close it within two days. Nevertheless, you might have seen currency trades that run for days or weeks, not only two days.

If traders wish to extend the trade beyond the two day limit, then they should close their position prior to 5.00pm EST on the settlement day and re-open it the next trading day. This action has the effect of extending the settlement by two more trading days. These days it’s being carried out automatically by all Forex brokers, so you do not need to really worry about it. Nevertheless, there is definitely a reason why you should be aware of this procedure.

This strategy is called rollover and is implemented using a forex swap agreement. However, this process also incurs a monetary loss or gain depending on the rate of interest differential between the two currencies of the pair that you are trading. This process might be repeated daily till the position is closed. As such, the rollover procedure entails closing a position and then re-opening it although at a slightly different price level. This distinction is the amount of debit or credit paid or earned that reflects the interest differential between the two currencies comprising the applicable currency pair being traded.

From an interest rate perspective, you’ll benefit from trading lengthy the currency with the greater yield. These Rollover interest adjustments are calculated utilizing the following formula:

I = P x D / (360 x E), where

I = Daily interest to be credited or debited

P = Value of your position in the second currency

E = Exchange Rate of the two currencies

D = Overnight interest differential of the two currencies of interest

For instance, assume you hold $10,000 USDCAD, the exchange rate for the pair is 0.9000 and also the interest rate is 5% for the CAD and 2% for the USD.

Rollover interest = $[(10,000*(5%-2%))/ (360*0.9000)] = $92.59

As you hold the higher yielding CAD, this amount could be added to your account. If, on the other hand you had held the USD, then the rollover charge would have been deducted out of your account balance. In the second case, you could have saved yourself this fee by considering closing the trade rather than rolling it over.

Remember this automated rollover is done each day that your trade is open. If you’d prefer to know how much you are credited or debited every day for a currency pair, you need to ask your broker what is the rollover rate for that pair. Also note that on Wednesday evening, most brokers credit or debit x3 (3 times) as much rollover rate compared to other days, to cover the rollover for the weekend.

Forex Pros – What’s The key To Effective Trading

There are lots of novices that enter in to the Forex market with high hopes of getting wealthy overnight. They may have been inspired by the success of Forex Pros and they now want to enjoy the same type of success themselves.

There is absolutely nothing wrong in following in the footsteps of successful people. However they should be willing to discover the key of their achievement and discipline themselves to adhere to and implement their strategies consistently.

What is the Forex Pros Secret to Success

First of all, novices have to realize that there is no secret formula to successful trading. Most Forex Pros are effective due to their immense knowledge and years of experience trading in the marketplace. Their familiarity using the method and also the insight that they had gained through the years now assist them to judge the movements correctly in order to make accurate predictions. This ability comes by experience alone and can’t be acquired via a secret formula.

However, you will find certain great practices that Forex Pros implement that assists them to possess an edge over the rest of the traders. Listed here are a few of them which might be practiced by any trader to gain an advantage in the market.

The first step is to identify emerging trends

Identifying an emerging trend is one of the foremost elements of successful trading. It might be a difficult exercise for many novices but nevertheless, they need to learn the abilities necessary to be able to spot trends in the market. As soon as they get the hang of it, they would find this exercise simpler as they acquire much more experience over time.

Secondly, one should setup a stop order or exit limit

Lack of discipline is one from the main issues with novices. They might want to hold on to a losing trade against the market. In order to stop this, one ought to setup an exit limit or stop order. This will trigger the order after the price drops beneath a specific worth. This will stop the trader from suffering substantial losses if the marketplace doesn’t reverse for a considerable period of time.

Third, traders have to examine their trading pattern

Many novices treat Forex trading like gambling. If they suffer a loss, they just brush it aside and attempt once more, hoping they would have much better luck this time. They by no means stop and believe why they suffered a loss within the first place. They just trythings randomly, hoping for luck to come to their rescue. On the other hand, Forex Pros examine their trading pattern to see why each outcome went the way it did. This assists them determine what strategies really work for them and which ones do not. Therefore, examining one’s own trading pattern is very important for successful trading in the future.

Rather than utilizing a simple formula, Forex Pros follow these effective practices to assist them trade effectively. These qualities come with practice and experience and cannot be created overnight.

Many forex traders, particularly novices, may be very confused about forex swaps that are more commonly known as ‘rollover rates’. To start understanding this subject properly, you need to understand that all forex trades must be settled in two business days from their activation date.

The which means of this, is that in the event you opened a currency trade, you have to close it within two days. Nevertheless, you might have seen currency trades that run for days or weeks, not only two days.

If traders wish to extend the trade beyond the two day limit, then they should close their position prior to 5.00pm EST on the settlement day and re-open it the next trading day. This action has the effect of extending the settlement by two more trading days. These days it’s being carried out automatically by all Forex brokers, so you do not need to really worry about it. Nevertheless, there is definitely a reason why you should be aware of this procedure.

This strategy is called rollover and is implemented using a forex swap agreement. However, this process also incurs a monetary loss or gain depending on the rate of interest differential between the two currencies of the pair that you are trading. This process might be repeated daily till the position is closed. As such, the rollover procedure entails closing a position and then re-opening it although at a slightly different price level. This distinction is the amount of debit or credit paid or earned that reflects the interest differential between the two currencies comprising the applicable currency pair being traded.

From an interest rate perspective, you’ll benefit from trading lengthy the currency with the greater yield. These Rollover interest adjustments are calculated utilizing the following formula:

I = P x D / (360 x E), where

I = Daily interest to be credited or debited

P = Value of your position in the second currency

E = Exchange Rate of the two currencies

D = Overnight interest differential of the two currencies of interest

For instance, assume you hold $10,000 USDCAD, the exchange rate for the pair is 0.9000 and also the interest rate is 5% for the CAD and 2% for the USD.

Rollover interest = $[(10,000*(5%-2%))/ (360*0.9000)] = $92.59

As you hold the higher yielding CAD, this amount could be added to your account. If, on the other hand you had held the USD, then the rollover charge would have been deducted out of your account balance. In the second case, you could have saved yourself this fee by considering closing the trade rather than rolling it over.

Remember this automated rollover is done each day that your trade is open. If you’d prefer to know how much you are credited or debited every day for a currency pair, you need to ask your broker what is the rollover rate for that pair. Also note that on Wednesday evening, most brokers credit or debit x3 (3 times) as much rollover rate compared to other days, to cover the rollover for the weekend.

Forex Pros – What’s The key To Effective Trading

There are lots of novices that enter in to the Forex market with high hopes of getting wealthy overnight. They may have been inspired by the success of Forex Pros and they now want to enjoy the same type of success themselves.

There is absolutely nothing wrong in following in the footsteps of successful people. However they should be willing to discover the key of their achievement and discipline themselves to adhere to and implement their strategies consistently.

What is the Forex Pros Secret to Success

First of all, novices have to realize that there is no secret formula to successful trading. Most Forex Pros are effective due to their immense knowledge and years of experience trading in the marketplace. Their familiarity using the method and also the insight that they had gained through the years now assist them to judge the movements correctly in order to make accurate predictions. This ability comes by experience alone and can’t be acquired via a secret formula.

However, you will find certain great practices that Forex Pros implement that assists them to possess an edge over the rest of the traders. Listed here are a few of them which might be practiced by any trader to gain an advantage in the market.

The first step is to identify emerging trends

Identifying an emerging trend is one of the foremost elements of successful trading. It might be a difficult exercise for many novices but nevertheless, they need to learn the abilities necessary to be able to spot trends in the market. As soon as they get the hang of it, they would find this exercise simpler as they acquire much more experience over time.

Secondly, one should setup a stop order or exit limit

Lack of discipline is one from the main issues with novices. They might want to hold on to a losing trade against the market. In order to stop this, one ought to setup an exit limit or stop order. This will trigger the order after the price drops beneath a specific worth. This will stop the trader from suffering substantial losses if the marketplace doesn’t reverse for a considerable period of time.

Third, traders have to examine their trading pattern

Many novices treat Forex trading like gambling. If they suffer a loss, they just brush it aside and attempt once more, hoping they would have much better luck this time. They by no means stop and believe why they suffered a loss within the first place. They just trythings randomly, hoping for luck to come to their rescue. On the other hand, Forex Pros examine their trading pattern to see why each outcome went the way it did. This assists them determine what strategies really work for them and which ones do not. Therefore, examining one’s own trading pattern is very important for successful trading in the future.

Rather than utilizing a simple formula, Forex Pros follow these effective practices to assist them trade effectively. These qualities come with practice and experience and cannot be created overnight.

Forex Trading Strategies

All About Forex Trading Strategies

Select a forex broker who’s known for rapid execution of orders; it might make all of the difference in successfully implementing a Stop Loss order. You should carry on monitoring a trend even following you have spotted it, this is to ensure that you can rectify your errors in case you spotted the trend wrongly or the trend reverses suddenly due to an incident. Identifying the marketplace sentiments are extremely important as traders have a tendency to stampede and act on intuitions throughout breaking of any news occasion.

Durable Goods Stock is really a essential economic indicator because it signals the country’s stock of raw materials and machineries and necessity of import and domestic production thus affecting the price of customer pairs. The higher the leverage, the higher is your opportunity of creating an enormous profit, and the higher will be the probability that you simply might have a massive loss in comparison to a lower leverage. Real estate purchases and construction is really a essential economic indicator as it greatly dictates the rates of interest of a country which in turn features a huge effect around the costs of currency pairs.

Take Profit orders are completely opposite to Stop Loss orders as they demarcate the maximum amount of profit from your trade, which once attained will automatically close the trade for you. Consumer Price Index (CPI) is a very essential financial indicator as it measures the average cost a country’s residents have paid for buying domestically and internationally created commodities. Countries that are dependent on import of oil from other countries tend to possess a weaker currency in the occasion of rise in oil costs.

Assistance and resistance are the price levels at which marketplace trends tend to reverse; identifying these will help you in choosing your forex trading strategy from advance. It’s recommended to open an account having a Forex market broker with a low leverage and then move on to higher leverages as soon as you identify a strong trend in the Forex market.

An honest Forex broker promotes fixed spreads and will not alter the currency pairs prices. When you effectively decipher a trend, you are able to predict the future behaviours of the currency’s price and buy or sell accordingly. Financial indicators or marketplace snippets are periodically released by government and private companies and a trader must adhere to these carefully to be able to successfully predict the trend in currency prices.

Huge change in market prices of currency pairs generally arise when unexpected economical or political events are reported. Playing big at one go implies greater risk and greater probability of incurring heavy losses. Loses are common whilst dealing with Forex markets but one loss shouldn’t demotivate you to take part in future trading within the marketplace. Product Price Index (PPI) is a very important economic indicator because it measures the average price received by domestic producers for the domestic and international sell of their goods.

Simple moving average technique of identifying trends uses every price point over the specified time period equally, that are added and averaged to obtain the trend line.

Forex Trading – What is Stop Loss

What Is Stop Loss In Forex Trading

In Forex trading, knowing where to location stop loss is a major ingredient for success. A good quantity of traders neglect this important aspect of trading and end up causing a great deal of unnecessary damage to their trading accounts. Stop loss refers to an order placed in the marketplace to stop you from incurring losses if price goes against you. When in a lengthy position, a stop loss order is usually placed some distance beneath the point of entry. And, when in a brief position, a stop loss order is usually placed some distance above the point of entry.

You will find various methods you can use to set stops, a few of which are

Equity Stop

Equity stop, also referred to as percentage stop, will be the most typical type of stop and it uses a predetermined fraction of a traders account to compute the distance the stop loss order ought to be placed from entry. For instance, you can be willing to danger 3% of your account in a trade; therefore, you’ll use this position size in computing where to place your stop loss order.

Volatility Stop

Volatility stop refers to placing a stop based on the quantity a market can possibly move over than a given time. This technique ensures the proper stop loss levels are placed so as to stop being taken out of a trade because of the random rise and fall of price. For instance, if you are using the swing trade strategy and you wish to trade the EUR/USD, you’ll not place your quit loss at 20 pips. This is simply because EUR/USD moves by about 100 pips each day.

Chart Stop

Chart stop is putting stops according to what the charts are saying. A good way of achieving this is putting stops according to substantial help and resistance levels. When you place stops beyond support and resistance levels, you can rest assured that your stops cannot be hit because they can potentially hold price from pushing via them.

In conclusion, stop losses are of essence in cutting down your losses when trading currencies. Regardless of what the marketplace does, when you have a correctly placed stop loss order, you wont be spending sleepless nights. The Forex marketplace is usually very dynamic in nature, so you never know when price will turn against you. Therefore, it’s important to place some preventive measures in place.

Select a forex broker who’s known for rapid execution of orders; it might make all of the difference in successfully implementing a Stop Loss order. You should carry on monitoring a trend even following you have spotted it, this is to ensure that you can rectify your errors in case you spotted the trend wrongly or the trend reverses suddenly due to an incident. Identifying the marketplace sentiments are extremely important as traders have a tendency to stampede and act on intuitions throughout breaking of any news occasion.

Durable Goods Stock is really a essential economic indicator because it signals the country’s stock of raw materials and machineries and necessity of import and domestic production thus affecting the price of customer pairs. The higher the leverage, the higher is your opportunity of creating an enormous profit, and the higher will be the probability that you simply might have a massive loss in comparison to a lower leverage. Real estate purchases and construction is really a essential economic indicator as it greatly dictates the rates of interest of a country which in turn features a huge effect around the costs of currency pairs.

Take Profit orders are completely opposite to Stop Loss orders as they demarcate the maximum amount of profit from your trade, which once attained will automatically close the trade for you. Consumer Price Index (CPI) is a very essential financial indicator as it measures the average cost a country’s residents have paid for buying domestically and internationally created commodities. Countries that are dependent on import of oil from other countries tend to possess a weaker currency in the occasion of rise in oil costs.

Assistance and resistance are the price levels at which marketplace trends tend to reverse; identifying these will help you in choosing your forex trading strategy from advance. It’s recommended to open an account having a Forex market broker with a low leverage and then move on to higher leverages as soon as you identify a strong trend in the Forex market.

An honest Forex broker promotes fixed spreads and will not alter the currency pairs prices. When you effectively decipher a trend, you are able to predict the future behaviours of the currency’s price and buy or sell accordingly. Financial indicators or marketplace snippets are periodically released by government and private companies and a trader must adhere to these carefully to be able to successfully predict the trend in currency prices.

Huge change in market prices of currency pairs generally arise when unexpected economical or political events are reported. Playing big at one go implies greater risk and greater probability of incurring heavy losses. Loses are common whilst dealing with Forex markets but one loss shouldn’t demotivate you to take part in future trading within the marketplace. Product Price Index (PPI) is a very important economic indicator because it measures the average price received by domestic producers for the domestic and international sell of their goods.

Simple moving average technique of identifying trends uses every price point over the specified time period equally, that are added and averaged to obtain the trend line.

Forex Trading – What is Stop Loss

What Is Stop Loss In Forex Trading

In Forex trading, knowing where to location stop loss is a major ingredient for success. A good quantity of traders neglect this important aspect of trading and end up causing a great deal of unnecessary damage to their trading accounts. Stop loss refers to an order placed in the marketplace to stop you from incurring losses if price goes against you. When in a lengthy position, a stop loss order is usually placed some distance beneath the point of entry. And, when in a brief position, a stop loss order is usually placed some distance above the point of entry.

You will find various methods you can use to set stops, a few of which are

Equity Stop

Volatility Stop

Chart Stop

Equity Stop

Equity stop, also referred to as percentage stop, will be the most typical type of stop and it uses a predetermined fraction of a traders account to compute the distance the stop loss order ought to be placed from entry. For instance, you can be willing to danger 3% of your account in a trade; therefore, you’ll use this position size in computing where to place your stop loss order.

Volatility Stop

Volatility stop refers to placing a stop based on the quantity a market can possibly move over than a given time. This technique ensures the proper stop loss levels are placed so as to stop being taken out of a trade because of the random rise and fall of price. For instance, if you are using the swing trade strategy and you wish to trade the EUR/USD, you’ll not place your quit loss at 20 pips. This is simply because EUR/USD moves by about 100 pips each day.

Chart Stop

Chart stop is putting stops according to what the charts are saying. A good way of achieving this is putting stops according to substantial help and resistance levels. When you place stops beyond support and resistance levels, you can rest assured that your stops cannot be hit because they can potentially hold price from pushing via them.

In conclusion, stop losses are of essence in cutting down your losses when trading currencies. Regardless of what the marketplace does, when you have a correctly placed stop loss order, you wont be spending sleepless nights. The Forex marketplace is usually very dynamic in nature, so you never know when price will turn against you. Therefore, it’s important to place some preventive measures in place.